2024 tax filing season set for January 29

IRS continues to make improvements to help taxpayers

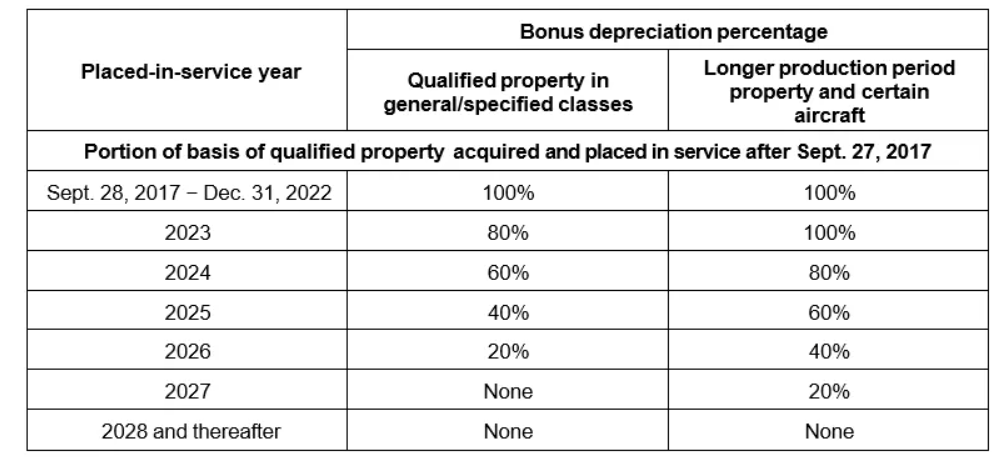

Read MoreUpdated bonus depreciation table

2024 revisions to bonus depreciation table

Read MoreERC temporary hold

What you need to know about ERC temprorary hold

Read MoreThink about EV Tax credit 2023

Did you purchase electric vehicle in 2023? You may be eligible for tax credit.

Read MoreTaxpayers can start filing their 2024 tax returns on January 22, 2024

The IRS will officially open the 2024 filing season for filing 2023 federal tax returns at the end of January 2024.

Read MoreIRS Expands Business Tax Accounts to Include S Corporations and Partnerships - CPA Practice Advisor

Individual partners of partnerships and individual shareholders of S corporation businesses are now eligible for a business tax account in addition to sole proprietors.

Read MoreIRS to waive $1 billion in penalties for people and firms owing back taxes for 2020 or 2021

Tax penaties will be waived for nearly 5 million people, businesses and tax-exempt organizations, which totals about $1 billion, the agency said.

Read MoreCovid-19 Business Support Employee Retention Credit

Your business may be still eligible for up to $5,000.00 in ERC credits per employee during 2020 and up to $7000.00 per employee per quarter during 2021

Read MoreBuild Back Better Act: Details & Analysis of Reconciliation Bill Taxes

More detailed look at the tax provisions of the 1.75 trillion build back better bill

Read MoreWhat's in the 1.2 trillion bill

What's in the 1.2 trillion bill

Read MoreIRS cracking down on goods and services transactions through apps like Venmo, Zelle

IRS crackdown on unreported transactions from cash apps

Read MoreWhat's in 1.75 trillion spending bill

Whats in 1.75 trillion spending bill

Read MoreUnderstanding Crypto Taxation

Crypto taxation

Read More